The Ultimate Guide To Eb5 Investment Immigration

Table of ContentsNot known Factual Statements About Eb5 Investment Immigration The Single Strategy To Use For Eb5 Investment ImmigrationSome Ideas on Eb5 Investment Immigration You Need To KnowA Biased View of Eb5 Investment ImmigrationOur Eb5 Investment Immigration Diaries

While we make every effort to use exact and updated material, it needs to not be considered lawful suggestions. Migration regulations and regulations go through alter, and private conditions can vary widely. For individualized assistance and lawful advice concerning your details migration situation, we highly suggest speaking with a certified migration lawyer who can provide you with tailored help and make sure compliance with existing regulations and policies.

Citizenship, through investment. Presently, since March 15, 2022, the quantity of investment is $800,000 (in Targeted Employment Areas and Country Locations) and $1,050,000 somewhere else (non-TEA zones). Congress has approved these amounts for the next five years starting March 15, 2022.

To get the EB-5 Visa, Investors should develop 10 permanent U.S. work within 2 years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement guarantees that financial investments add directly to the united state task market. This applies whether the tasks are produced directly by the company or indirectly under sponsorship of an assigned EB-5 Regional Center like EB5 United

The Facts About Eb5 Investment Immigration Revealed

These tasks are established through models that utilize inputs such as development expenses (e.g., building and devices costs) or annual revenues produced by continuous operations. On the other hand, under the standalone, or direct, EB-5 Program, just straight, full-time W-2 staff member settings within the business might be counted. An essential threat of depending entirely on direct workers is that team decreases due to market problems can result in inadequate permanent positions, possibly leading to USCIS denial of the investor's request if the task development requirement is not met.

The financial model then predicts the variety of direct tasks the new service is most likely to develop based on its expected profits. Indirect work computed with economic models refers to employment generated in sectors that supply the goods or services to business straight associated with the job. These jobs are developed as a result of the boosted need for items, products, or solutions that sustain business's operations.

The 25-Second Trick For Eb5 Investment Immigration

An employment-based 5th choice category (EB-5) investment visa supplies an approach of coming to be a permanent U.S. resident for international nationals hoping to invest capital in the USA. In order to look for this environment-friendly card, a foreign capitalist has to spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Location") and produce or maintain a minimum of 10 permanent tasks for USA workers (leaving out the capitalist and their immediate family members).

This procedure has been an incredible success. Today, 95% of all EB-5 funding is increased and spent by Regional Centers. Considering that the 2008 monetary dilemma, access to funding has been restricted and municipal budgets remain to face considerable shortages. In many areas, EB-5 financial investments have actually filled the funding void, giving a look at these guys new, essential source of capital for neighborhood economic growth jobs that rejuvenate communities, create and support jobs, facilities, and solutions.

A Biased View of Eb5 Investment Immigration

workers. Additionally, the Congressional Spending Plan Office (CBO) scored the program as profits neutral, with management costs spent for by candidate fees. EB5 Investment Immigration. Greater than 25 nations, including Australia and the UK, use comparable programs to draw in foreign investments. The American program is more rigorous than numerous others, requiring considerable danger for investors in regards to both their financial investment and migration standing.

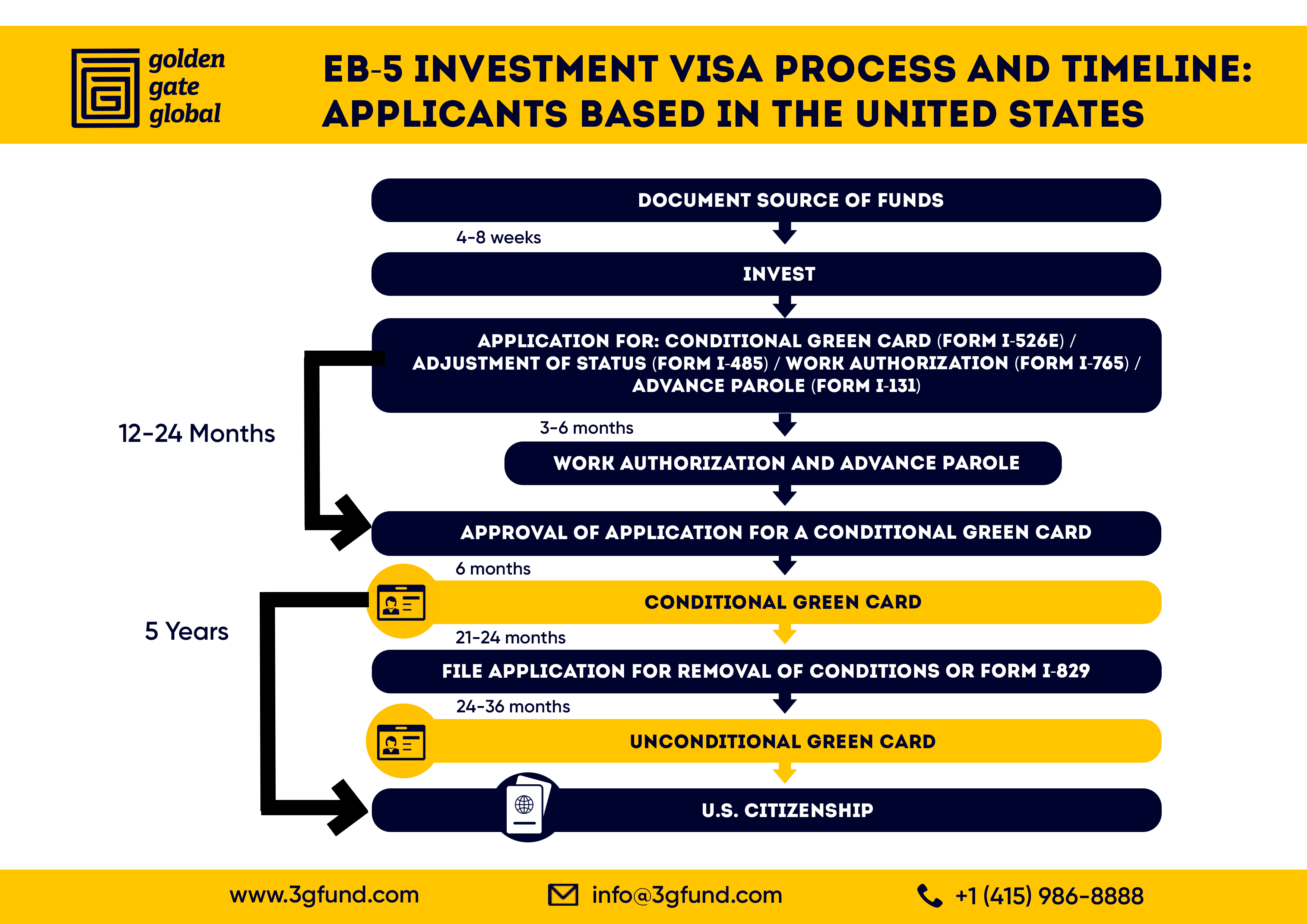

Households and individuals that seek to move to the United States on a long-term basis can use for the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) established out numerous needs to get permanent residency with the EB-5 visa program.: The very first step is to discover a qualifying investment chance.

When the chance has been identified, the financier must make the investment and submit an I-526 request to the U.S. Citizenship and Migration Services (USCIS). This application has to consist of proof of the investment, such as bank statements, purchase arrangements, and organization strategies. The USCIS will review the I-526 application and either accept it or demand extra proof.

Getting The Eb5 Investment Immigration To Work

The financier must obtain conditional residency by submitting an I-485 application. This request Full Report must be sent within 6 months of the I-526 authorization and need to include proof that the investment was made and that it has actually produced at least 10 permanent tasks for U.S. employees. The USCIS will assess the I-485 request and either accept it or request added evidence.